The Advance Block candlestick pattern is a three-day formation.

Introduction :

The Advance Block candlestick pattern consists of three consecutive bullish candles.

• While the security is making new highs, the real bodies of the bullish candles are getting progressively smaller.

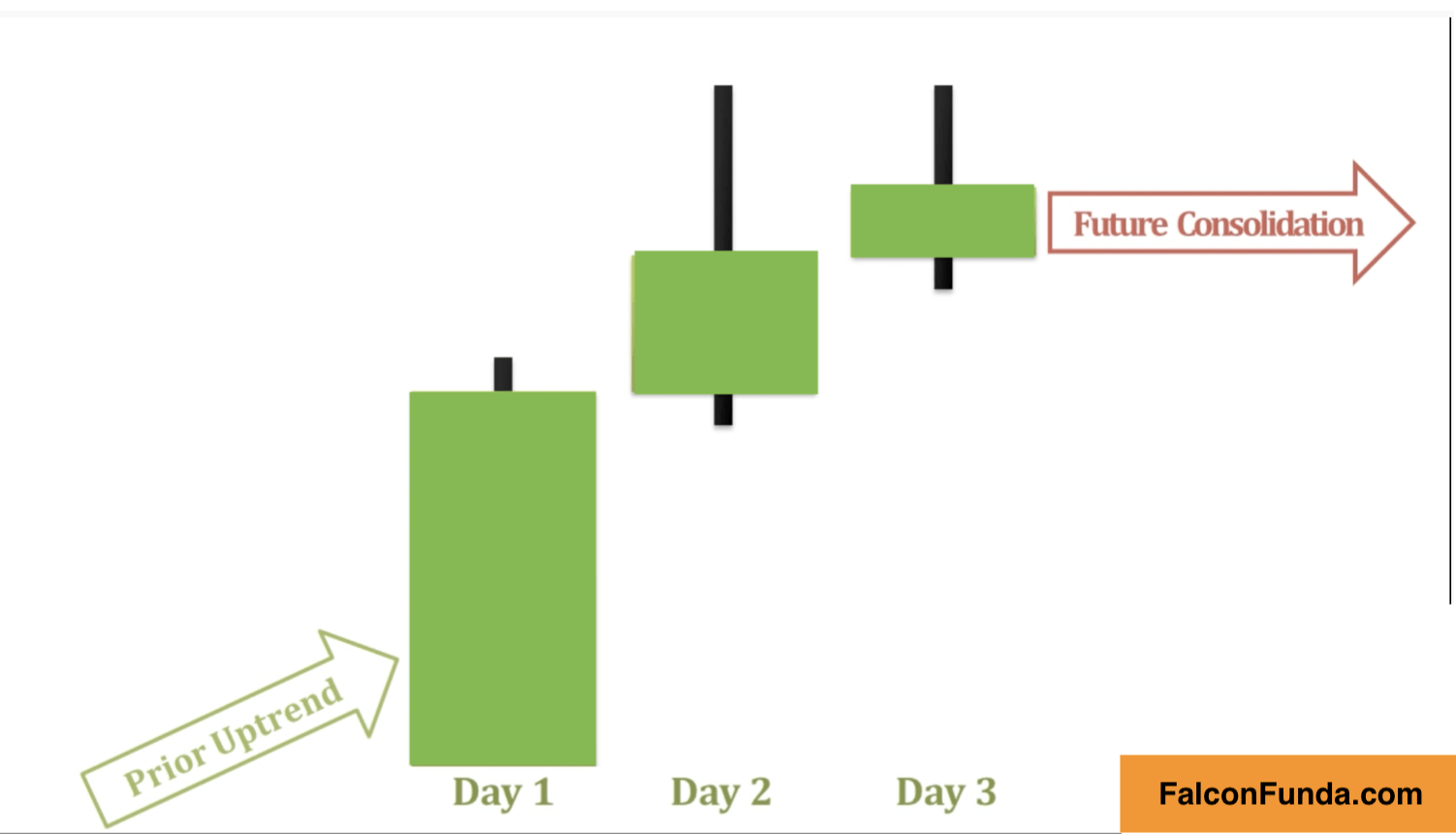

• This pattern typically occurs during an uptrend, and while it doesn’t necessarily indicate a reversal, it can be a warning sign of a slowing uptrend.

What is Advance Block Candlestick pattern ?

The Advance Block candlestick pattern is a three-day formation that traders use to identify potential changes in an uptrend’s momentum. This pattern typically occurs during an uptrend, and while it doesn’t necessarily indicate a reversal, it can be a warning sign of a slowing uptrend.

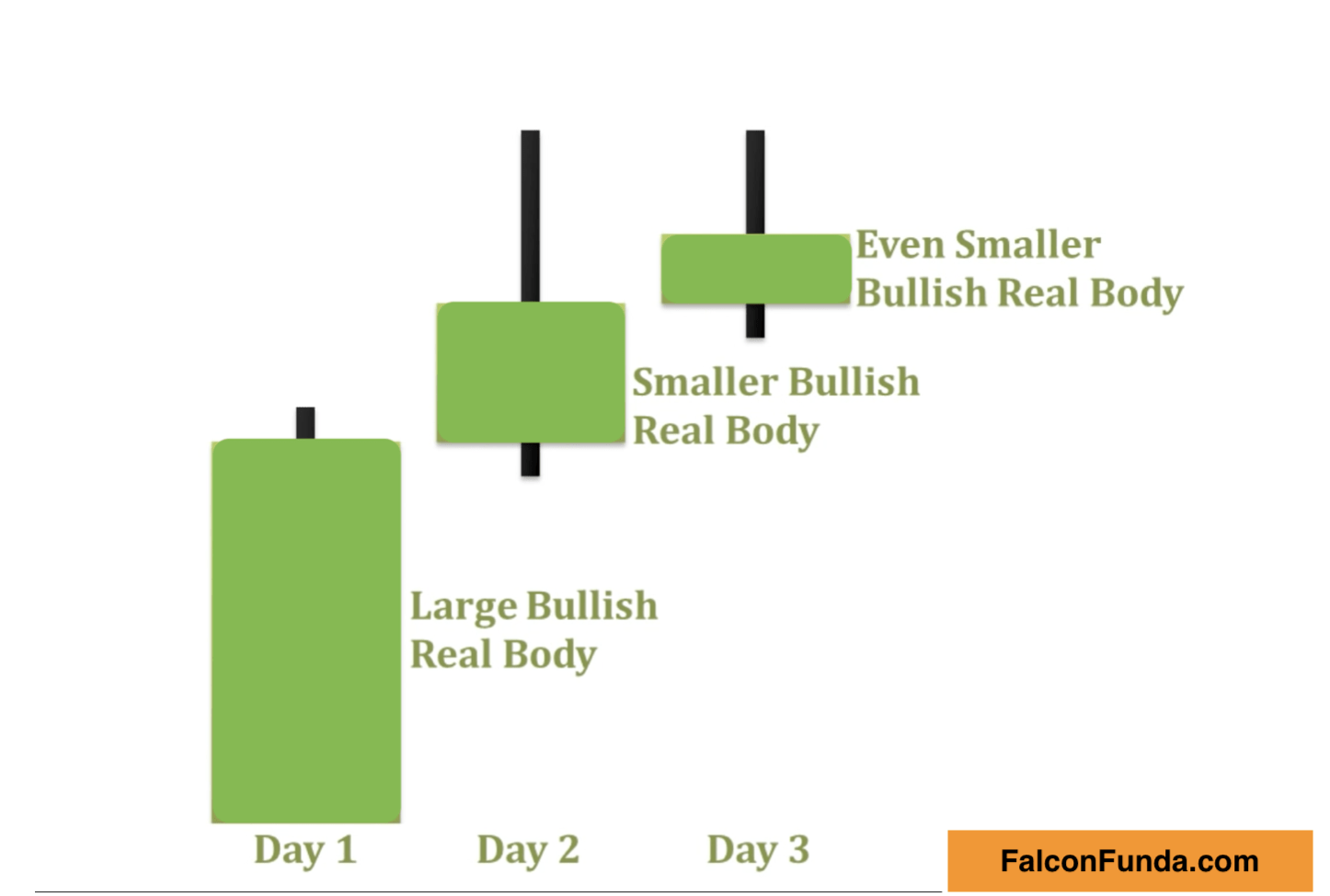

The Advance Block pattern consists of three consecutive bullish candles.

The first candle is a long bullish candle that signifies a strong buying presence in the market.

The second day brings another long bullish candle that opens within the real body of the first day’s candle, and closes above the high of the first day. It also features a long upper shadow, indicating that buyers are still pushing the price higher, but encountering some resistance from sellers.

The third day is a small bullish candlestick that usually opens within the second day’s real body and closes above its close, also featuring an upper shadow.

Advance Block Candlestick Pattern

Advance Block Candlestick Pattern

Why is Advance Block Candlestick Pattern important ?

The psychology behind this pattern is that while the security is making new highs, the real bodies of the bullish candles are getting progressively smaller, signaling a potential weakening of the bullish momentum.

The upper shadows show that buyers are still trying to push prices higher, but bears are successfully pushing the price down from its highs, leading to gradually smaller gains for the bulls.

By identifying the Advance Block pattern, traders can potentially take advantage of the slowdown in the uptrend by exiting long positions or hedging against potential losses. It is a useful tool for technical analysis and should be included in any trader’s arsenal.

As like any other, Tri-Star pattern require sconfirmation in the following days.If future day candlesticks go above the last day candlestick(s) the pattern is voided. You can identify Tri-Star pattern by applying it from indicators list on your TradingView chart.

Next Read: Tri-Star Candlestick Pattern